Tax Allowance for Car Malaysia

Most of the countries have local taxes of less than 20 whereas Malaysia has an excise tax of 105. If I purchase a Hilux as the commercial vehicle for my company my first instalment on it would fall on 1 December 2020 and the financial year-end for Home Transformasi Sdn Bhd falls each year on 31 December.

List Of Tax Deduction For Businesses Cheng Co Group

14 Income remitted from outside Malaysia.

. Car allowance income tax liability depends on. Of course this probably means AC home chargers. Just like Benefits-in-Kind Perquisites are taxable from employment income.

Subsidies on interest for housing education car loans. The larger a vehicles engine the more road tax is payable. As for the industry he said the country would take the.

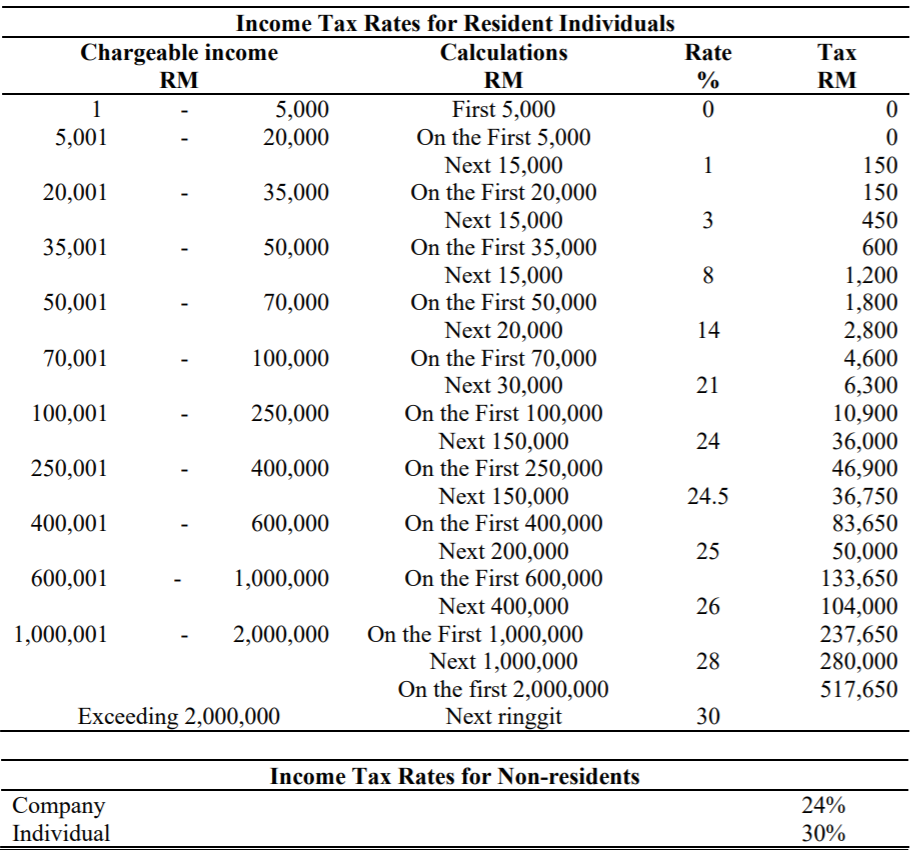

From the 2018-2019 financial year the fixed sickness benefit and the transport allowance have been replaced by a flat-rate deduction. My employer has lump this amount to car allowance in the EA form. Income Tax Rates and Thresholds Annual Tax Rate.

Please remember that you still need to pay tax for your benefits in kind after you have fully claim RM50000 RM100000 capital allowance on motor vehicle. Also 10 percent of RM 50000 is just RM 5000 while 10 percent of RM 200000 is RM 20000 so unless you are buying a high-end car the quantum of savings is not going to be any different from the seasonal promotions given out by dealers. The amount of road tax depends on the following factors.

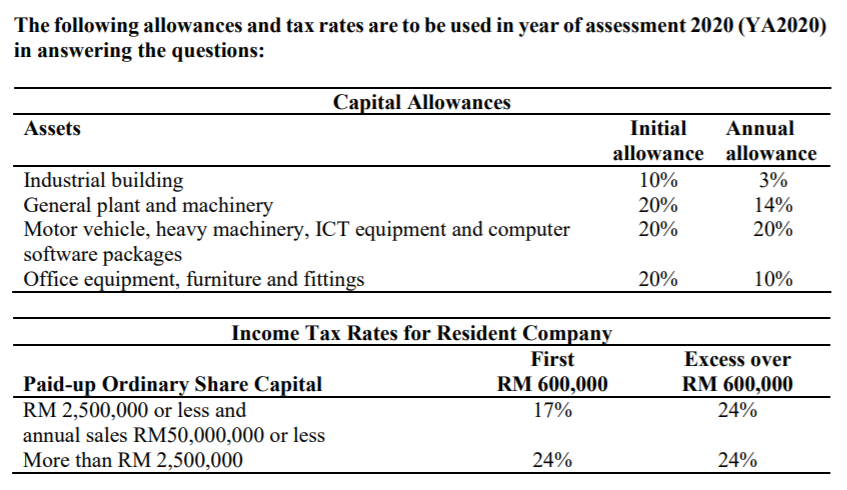

More on Malaysia income tax 2019. List the price range according to these different factors and link externally to the JPJ website. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

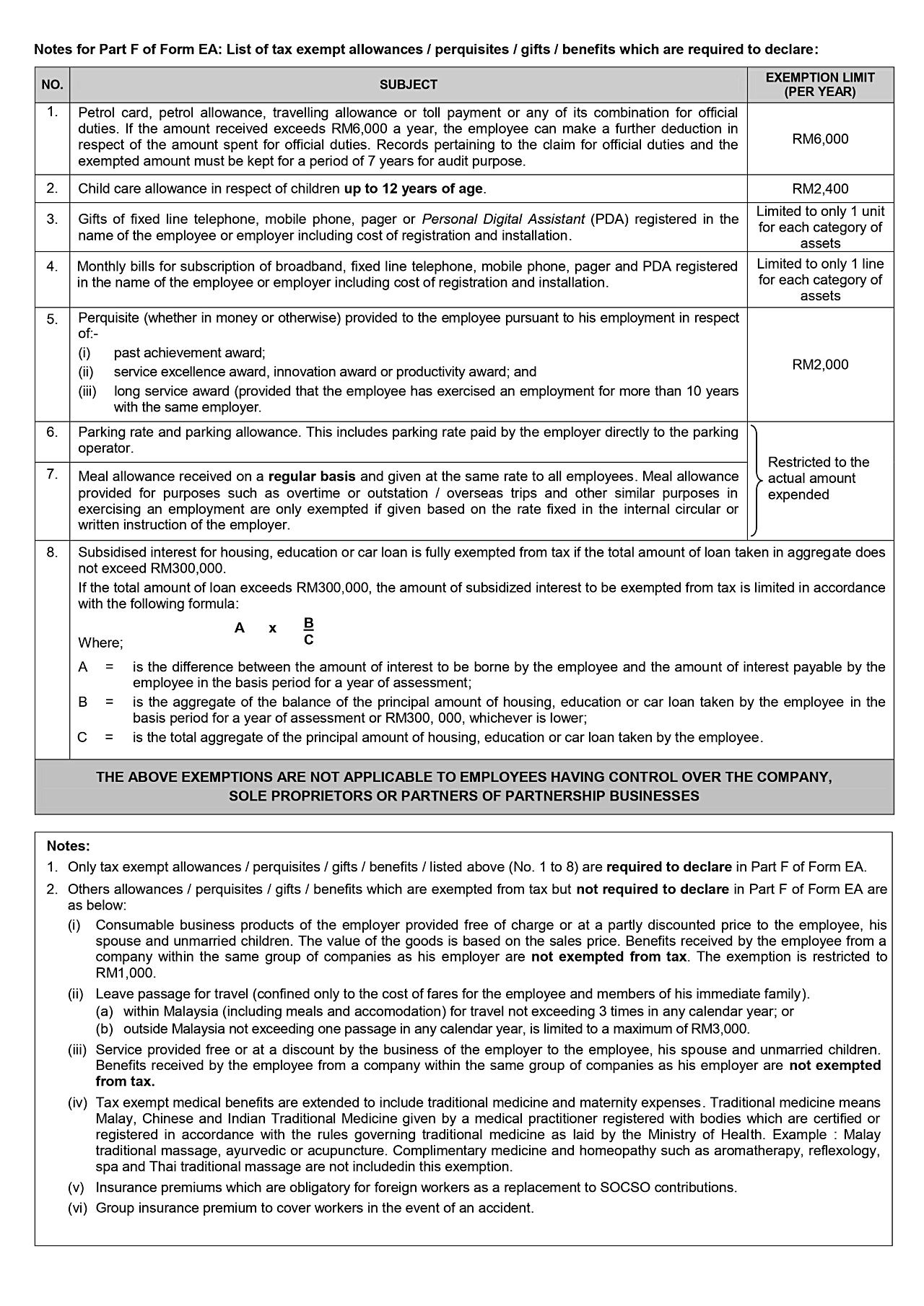

Travelling allowance petrol allowance toll rate up to RM6000 annually. How To Maximise Your Income Tax Refund Malaysia 2022 YA2021. In order to help you gauge the amount you have to pay for your roadtax we share in this article the latest car roadtax prices for private cars in West and East Malaysia.

If you compare the actual price of the vehicle the amount that you would pay isnt too bad. Hello if my employer gives me an allowance for my car loan and apartment is it exempt from tax. Tax exempt up to RM2400 per year.

Flat rate on all taxable income. Road tax is used to pay for maintaining the road network nationwide. Since Mosis Sdn Bhd owns the asset and uses it in its business the company is entitled to claim initial allowance and annual allowance.

Parking rate or parking allowance. On the electric ownership side he mentioned road tax exemption and income tax relief for Malaysians who purchase electric vehicles. We will not discuss tax deduction in interest payment and balancing charge for disposal of motor vehicle as there are too many uncertainties.

The bulk of the inflated price of our cars is coming from excise tax and import tax both remain unchanged. The annual allowance is given for each year until the capital expenditure has been fully written off unless. The annual allowance for motor vehicles is available at the accelerated rate of 20 as compared to the rate of 14 for other plant or.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. RM140000 is incurred on 1 May 2014 as ownership passes on that date. Road Tax and Insurance.

Child care allowance of up to RM2400 annually. How To File Your Taxes For The First Time. Whether the car is diesel or petrol.

While annual allowance is a flat rate given every year based on the original cost of the asset. Includes payment by the employer directly to the childcare provider. The big issue is whether it is an advantage to have a company car at ones disposal or whether it will be better to use ones own car for business purposes with the possibility of mileage allowance.

Car Road Tax Price EN. For example if you take up a job while overseas and you only receive the payment for the job when you are back in. Hire Purchase Installment 3 Interest Rate for 5 Years.

Tax exempt as long the amount is not unreasonable. Anonymous 8 months ago If my salary is pay by cash how to submit. Road Tax for Electric Vehicle JPJ Road Tax for Commercial Vehicles.

However there are exemptions. In Malaysia car insurance is compulsory and road tax also has to be paid by car owners. It comes down to the total price though and this is affected by the excise tax.

Petrol allowance petrol card travelling allowance or toll payment or any combination. I propose that all senior citizens with valid driving license and owns a car should be given free road tax up to 2 liter cars and 70 discount. Includes payment by the employer directly to the parking operator.

It is mandatory for every car owner in Malaysia to have a valid Motor Vehicle License LKM or roadtax to legally drive on Malaysian public roads. Motor Vehicle License LKM rates calculation guidelines for Electric Vehicles in in the link. This would be complemented by further income tax relief for the installation of EV charging facilities.

The tax exemption for medical reimbursements is no longer applicable. Malaysia Non-Residents Income Tax Tables in 2022. Road Tax for Private Car and Motorcycle JPJ Road Tax for Electric Vehicle.

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

List Of Tax Deduction For Businesses Cheng Co Group

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Company Car Benefit Should I Declare It On My Income Tax Filing

Comments

Post a Comment